The Economics of Running an Upwork Agency: Understanding Your True Unit Economics

Master the financial fundamentals that separate profitable agencies from those that struggle. The complete guide to agency economics and profitability.

Most agency owners are terrible at understanding their true economics. They celebrate revenue milestones while their profit margins shrink. They add team members without calculating the real cost. They price services based on competition instead of value. This financial blindness kills more agencies than any other factor.

After analyzing the financial data from 300+ agencies, I've identified the key economic principles that separate sustainably profitable agencies from those that struggle despite high revenue. This isn't about accounting—it's about understanding the fundamental economics that drive long-term success.

The Agency Economics Foundation

Understanding Unit Economics

Unit economics answers the fundamental question: How much money do you make per client, per project, per hour, and per team member?

Key unit economic metrics:

- Revenue per client: Total revenue divided by number of clients

- Profit per project: Net profit after all costs per project

- Effective hourly rate: True hourly earnings after all expenses

- Revenue per team member: Total revenue divided by team size

The Agency Profit Equation

Agency Profit = (Revenue per Client × Number of Clients) - (Fixed Costs + Variable Costs)

Breaking this down:

- Revenue per Client: What each client pays annually

- Number of Clients: Your client capacity

- Fixed Costs: Overhead that doesn't change with client volume

- Variable Costs: Expenses that scale with client work

The Hidden Costs Most Agencies Miss

Administrative time: Proposal writing, communication, project management Context switching: Lost productivity from juggling multiple projects Quality control: Review, revision, and rework time Business development: Sales, marketing, and relationship building Learning curve: Time spent training and onboarding

The True Cost of Client Acquisition

Client Acquisition Cost (CAC) Calculation

CAC = Total Sales & Marketing Costs / Number of New Clients Acquired

Components of CAC:

- Direct costs: Advertising, Upwork fees, tools

- Time costs: Proposal writing, pitching, relationship building

- Opportunity costs: Revenue lost during acquisition activities

- Overhead allocation: Portion of fixed costs attributable to sales

The CAC Payback Period

How long does it take to recover client acquisition costs?

Formula: CAC / Monthly Revenue per Client = Payback Period in Months

Example:

- CAC: $2,000

- Monthly revenue per client: $4,000

- Payback period: 0.5 months

Benchmark: Healthy agencies recover CAC within 3-6 months

Lifetime Value (LTV) to CAC Ratio

LTV:CAC ratio measures the return on acquisition investment

LTV = Average Monthly Revenue per Client × Average Client Retention (months)

Healthy ratios:

- 3:1 minimum: Sustainable but not optimal

- 5:1 ideal: Strong profitability and growth potential

- 8:1+ exceptional: Premium positioning and excellent retention

The Team Economics Model

The True Cost of Team Members

Beyond salary considerations:

Direct costs:

- Salary or contractor fees

- Benefits and payroll taxes

- Equipment and software licenses

- Training and development

Indirect costs:

- Management time and overhead

- Communication and coordination

- Quality control and review

- Administrative support

Opportunity costs:

- Your time spent managing vs. selling

- Potential productivity loss during onboarding

- Capacity constraints during training

Revenue per Team Member Analysis

Calculate productivity and profitability:

Formula: Total Agency Revenue / Number of Team Members

Industry benchmarks:

- Struggling agencies: $60k-$100k per team member

- Healthy agencies: $150k-$250k per team member

- Exceptional agencies: $300k+ per team member

The Team Scalability Equation

When does adding team members increase profitability?

New team member is profitable when: Revenue Generated by New Hire > (Salary + Benefits + Overhead + Management Time)

Key factors:

- Utilization rate of new hire

- Billing rate vs. cost rate

- Management bandwidth available

- Training and ramp-up time

Pricing Strategy and Economics

Cost-Plus vs. Value-Based Pricing

Cost-plus pricing:

- Calculate all costs and add desired margin

- Predictable but limits profitability

- Suitable for commodity services

Value-based pricing:

- Price based on client value received

- Higher margins but requires positioning

- Ideal for strategic services

The Pricing Psychology

Client's economic decision: ROI from your service > Cost of your service

Your pricing power comes from:

- Unique expertise or positioning

- Proven results and case studies

- Scarcity and demand

- Relationship depth and trust

Dynamic Pricing Strategies

Adjust pricing based on:

- Client size and budget

- Project complexity and risk

- Timeline and urgency

- Market demand and competition

- Your capacity and availability

The Cash Flow Management System

The Agency Cash Flow Cycle

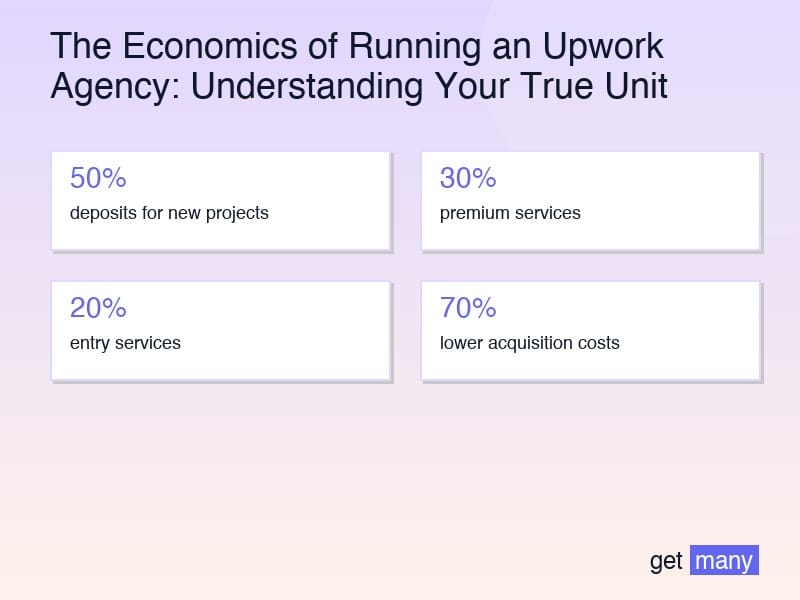

Understanding cash flow timing:

- Proposal phase: Investment with no immediate return

- Project start: Partial payment, full cost commitment

- Project delivery: Ongoing costs, delayed revenue

- Project completion: Final payment, profit realization

Cash Flow Optimization Strategies

Improve cash flow through:

- Upfront payments: 50% deposits for new projects

- Milestone billing: Regular payments throughout projects

- Retainer agreements: Monthly recurring revenue

- Faster collections: Net 15 instead of Net 30 terms

The Cash Flow Cushion

Maintain cash reserves for:

- 3-6 months of operating expenses

- Seasonal revenue fluctuations

- Unexpected client losses

- Growth investment opportunities

Profitability Analysis by Service Line

Service Profitability Matrix

Analyze each service for:

- Revenue potential: Maximum revenue per project

- Profit margins: Net profit after all costs

- Scalability: Ability to increase capacity

- Market demand: Client need and willingness to pay

High-Margin vs. High-Volume Services

High-margin services:

- Strategic consulting

- Specialized expertise

- Complex problem-solving

- Custom solutions

High-volume services:

- Standardized deliverables

- Repeatable processes

- Scalable systems

- Commoditized work

The Service Portfolio Optimization

Ideal service mix:

- 30% premium services: High margin, strategic value

- 50% core services: Balanced margin and volume

- 20% entry services: Lead generation and relationship building

The Economics of Specialization

Niche Market Economics

Benefits of specialization:

- Higher pricing power: Expertise commands premium

- Lower acquisition costs: Referrals and reputation

- Increased efficiency: Repeatable processes

- Better client relationships: Deep understanding

The Specialization ROI

Specialization typically results in:

- 20-50% higher pricing

- 30-70% lower acquisition costs

- 15-25% higher profit margins

- 40-80% better client retention

Geographic and Industry Focus

Economic advantages:

- Geographic focus: Local market knowledge, relationship networks

- Industry focus: Deep expertise, specialized processes

- Service focus: Operational efficiency, premium positioning

Technology Investment and ROI

Technology as a Profit Center

Technology investments should:

- Reduce operational costs: Automation and efficiency

- Increase revenue per client: Better service delivery

- Improve client satisfaction: Enhanced experience

- Enable scalability: Handle more clients with same team

The Technology ROI Calculation

ROI = (Cost Savings + Revenue Increases) / Technology Investment

Example:

- Technology investment: $10,000

- Annual cost savings: $15,000

- Annual revenue increase: $25,000

- ROI: 300%

The Getmany Economic Impact

Getmany's economic benefits:

- Reduced acquisition costs: Automated proposal generation

- Increased win rates: Better proposal quality

- Time savings: 20+ hours per month freed up

- Revenue growth: More opportunities pursued

Typical ROI: 500-1000% within first year

Economic Scenario Planning

Best Case Scenario Modeling

Plan for success:

- Revenue growth projections

- Team expansion requirements

- Technology investment needs

- Market expansion opportunities

Worst Case Scenario Preparation

Plan for challenges:

- Client loss impact analysis

- Revenue decline responses

- Cost reduction strategies

- Cash flow management

The Economic Stress Test

Questions to ask:

- What happens if we lose our biggest client?

- How long can we operate without new business?

- What's our minimum viable revenue?

- Which costs can we cut quickly?

Key Performance Indicators (KPIs)

Financial KPIs

Revenue metrics:

- Monthly recurring revenue (MRR)

- Revenue growth rate

- Revenue per client

- Revenue per team member

Profitability metrics:

- Gross profit margin

- Net profit margin

- Client profitability

- Project profitability

Operational KPIs

Efficiency metrics:

- Utilization rates

- Project completion time

- Quality metrics

- Client satisfaction scores

Growth metrics:

- Client acquisition rate

- Client retention rate

- Average project value

- Market share

Industry Benchmarks and Comparisons

Agency Performance Benchmarks

Revenue growth:

- Struggling agencies: 0-10% annual growth

- Healthy agencies: 15-30% annual growth

- High-growth agencies: 40%+ annual growth

Profit margins:

- Struggling agencies: 5-15% net margin

- Healthy agencies: 20-35% net margin

- Exceptional agencies: 40%+ net margin

Competitive Analysis

Compare your agency on:

- Pricing strategies

- Service offerings

- Client satisfaction

- Market positioning

- Growth trajectories

Financial Planning and Forecasting

The 12-Month Financial Plan

Monthly planning includes:

- Revenue projections

- Cost budgets

- Cash flow forecasts

- Profitability targets

The Growth Investment Strategy

Reinvestment priorities:

- Team expansion

- Technology upgrades

- Marketing and sales

- Process improvements

Exit Strategy Economics

Building value for:

- Future sale preparation

- Investor attraction

- Succession planning

- Wealth building

Your Economic Optimization Action Plan

Month 1: Economic Assessment

- Calculate current unit economics

- Analyze client profitability

- Assess team productivity

- Review pricing strategies

Month 2: Cost Optimization

- Identify cost reduction opportunities

- Negotiate better vendor terms

- Optimize operational efficiency

- Implement financial controls

Month 3: Revenue Enhancement

- Optimize pricing strategies

- Improve service mix

- Increase client lifetime value

- Expand service offerings

Month 4-6: Strategic Implementation

- Execute optimization strategies

- Monitor performance metrics

- Adjust based on results

- Plan for sustainable growth

The Bottom Line

Understanding your agency's economics isn't optional—it's essential for sustainable growth and profitability. The agencies that master their unit economics make better decisions, grow more profitably, and build more valuable businesses.

Focus on the metrics that matter: client lifetime value, acquisition costs, team productivity, and profit margins. Use this data to make informed decisions about pricing, hiring, and growth strategies.

Remember: Revenue is vanity, profit is sanity, and cash flow is reality. Build your agency on solid economic foundations, and you'll create a business that thrives in any market condition.

The economics of your agency determine its long-term success. Invest the time to understand and optimize them, and you'll build a sustainably profitable business that serves you and your clients for years to come.

Ready to optimize your agency's economics? Getmany can help you reduce acquisition costs and increase win rates, directly improving your unit economics. Start building a more profitable agency today.