Exit Strategies: Selling Your Upwork Agency

Building an agency to sell requires strategic planning from day one. Learn how to structure your business for maximum valuation and successful exit.

The most successful agency owners think about their exit strategy from the moment they hire their first employee. This isn't pessimistic thinking—it's strategic planning that creates businesses worth buying. While most agencies remain lifestyle businesses that disappear when the founder steps away, the agencies that plan for eventual sale build systems, processes, and value that transcend individual ownership.

After studying dozens of successful agency acquisitions, one pattern emerges clearly: the agencies that sell for premium multiples aren't necessarily the largest or most profitable—they're the ones that build transferable value from day one. These agencies understand that every operational decision, every system implementation, and every client relationship either increases or decreases their eventual sale value.

The data is compelling: agencies structured for sale typically achieve 3-5x higher valuations than those operating as lifestyle businesses. But here's what's crucial—this premium comes from intentional decisions made years before the sale, not from preparations made months before listing.

Understanding Agency Valuation Fundamentals

Agency valuations operate on different principles than traditional business sales. Unlike product companies with physical assets or software companies with intellectual property, agency value lies in operational efficiency, client relationships, and growth potential.

Revenue Multiples and Their Drivers

Most agency sales occur at 0.5-2x annual revenue, but the multiple depends entirely on business structure:

Premium Multiple Drivers (1.5-2x revenue):

- Recurring revenue contracts exceeding 60% of total revenue

- Documented systems and processes that operate independently of the founder

- Diversified client base with no single client exceeding 15% of revenue

- Strong growth trajectory with 25%+ annual revenue increases

- Experienced management team capable of operating without the founder

Standard Multiple Drivers (0.8-1.2x revenue):

- Project-based revenue with some recurring elements

- Partially documented processes requiring founder involvement

- Moderate client concentration with largest client under 25% of revenue

- Stable growth with 10-20% annual increases

- Competent team requiring ongoing founder oversight

Discount Multiple Drivers (0.5-0.8x revenue):

- Primarily project-based revenue with limited recurring elements

- Founder-dependent operations with minimal documentation

- High client concentration with largest client exceeding 30% of revenue

- Inconsistent growth or declining revenue trends

- Team heavily dependent on founder for direction and client relationships

The Transferable Value Framework

The key to premium valuations lies in building transferable value—business assets that function independently of the founder. This framework includes:

Operational Independence:

- Documented workflows that any competent manager can execute

- Systems that handle client acquisition, project delivery, and quality assurance

- Performance metrics that provide visibility into business health

- Standard operating procedures that ensure consistent output

Client Relationship Transferability:

- Established account management processes that clients trust

- Multiple relationship touchpoints beyond the founder

- Documented client preferences, communication patterns, and project histories

- Proven client retention strategies that don't depend on founder charisma

Revenue Predictability:

- Recurring revenue streams that provide cash flow stability

- Diversified client base that reduces concentration risk

- Growth systems that generate consistent new business

- Pricing models that protect margins and ensure profitability

Building a Sellable Agency Structure

Creating a sellable agency requires intentional structure from the beginning. This isn't about preparing for sale—it's about building a business that could be sold, whether or not you ever choose to sell.

Revenue Stream Optimization

The most valuable agencies have predictable revenue streams:

Recurring Revenue Development:

- Monthly retainer contracts for ongoing services

- Maintenance agreements for completed projects

- Subscription-based service offerings

- Long-term contracts with automatic renewal clauses

Client Diversification Strategy:

- Maximum client concentration limits (15% of revenue)

- Systematic client acquisition processes

- Multiple service offerings that appeal to different client types

- Geographic diversification to reduce market risk

Revenue Growth Systems:

- Documented lead generation processes

- Scalable service delivery models

- Upselling and cross-selling programs

- Referral systems that operate independently

Operational Systematization

Buyers purchase systems, not people. The most valuable agencies have:

Process Documentation:

- Step-by-step workflows for all service delivery

- Quality assurance checklists and standards

- Client onboarding and offboarding procedures

- Project management methodologies

Technology Infrastructure:

- Integrated systems that provide business visibility

- Automated workflows that reduce manual intervention

- Data management systems that protect client information

- Performance monitoring tools that track key metrics

Team Development:

- Clearly defined roles and responsibilities

- Documented training programs for new hires

- Performance management systems

- Succession planning for key positions

Case Study: The $1.2M Agency Sale

One of the most instructive agency sales involved a digital marketing agency that sold for $1.2M at 1.8x annual revenue. The sale succeeded because the founder spent three years building systems specifically designed for transferability.

The Preparation Strategy

Years 1-2: Foundation Building

- Documented all service delivery processes

- Implemented integrated project management and CRM systems

- Developed standard operating procedures for all functions

- Built a management team capable of independent operation

Year 3: Optimization and Documentation

- Created comprehensive operations manuals

- Established performance metrics and reporting systems

- Implemented client retention programs

- Developed scalable lead generation processes

Sale Preparation (6 months):

- Compiled three years of financial documentation

- Created detailed business operations overview

- Developed management transition plan

- Prepared client transition strategy

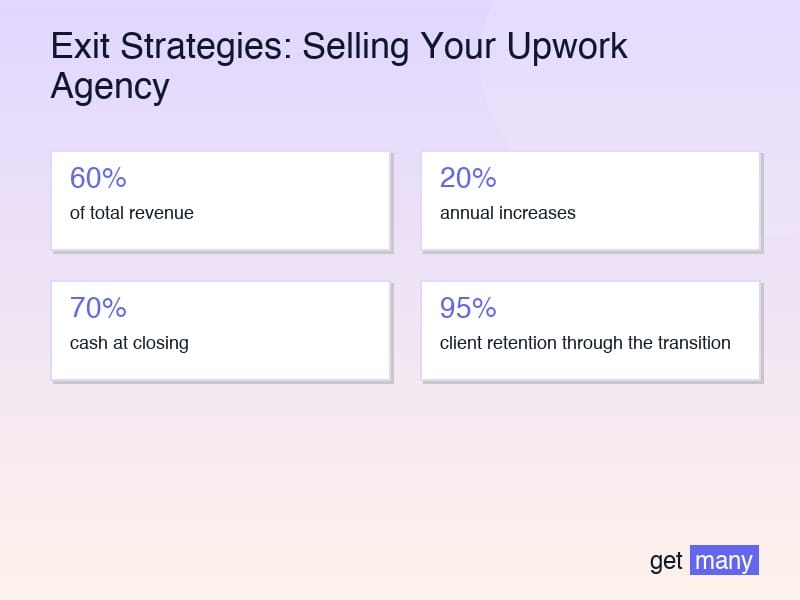

The Sale Structure

The sale included:

- 70% cash at closing ($840K)

- 30% earn-out over 18 months ($360K)

- 90-day founder transition period

- Two-year non-compete agreement

- Client retention guarantees

The Results

Post-sale performance demonstrated the value of systematic preparation:

- 95% client retention through the transition

- Management team successfully operated without founder involvement

- Revenue growth continued at 20% annually

- Earn-out payments were achieved ahead of schedule

Buyer Types and Their Motivations

Understanding potential buyers helps structure your agency for maximum appeal:

Strategic Buyers

These buyers purchase agencies to enhance their existing operations:

Marketing Agencies: Acquiring specialized capabilities or client segments Technology Companies: Adding service capabilities to product offerings Consulting Firms: Expanding digital marketing or technical services Private Equity: Building portfolio companies through acquisition

Strategic buyers typically pay premium multiples because they can realize synergies and scale that independent operators cannot achieve.

Financial Buyers

These buyers purchase agencies as investment opportunities:

Individual Investors: Seeking businesses they can operate or manage Investment Groups: Looking for stable cash flow and growth potential Competitor Agencies: Acquiring market share and capabilities Employee Groups: Management buyouts or employee stock ownership plans

Financial buyers focus on cash flow generation and typically pay multiples based on earnings rather than revenue.

Preparation Strategies by Buyer Type

For Strategic Buyers:

- Emphasize unique capabilities and market positioning

- Highlight growth potential and scalability

- Demonstrate complementary strengths and synergy opportunities

- Provide detailed market analysis and competitive positioning

For Financial Buyers:

- Focus on cash flow consistency and profitability

- Demonstrate operational efficiency and cost management

- Highlight recurring revenue and client retention

- Provide detailed financial projections and growth scenarios

The Sale Process: From Listing to Closing

Successfully selling an agency requires systematic process management:

Pre-Sale Preparation (6-12 months)

Financial Documentation:

- Three years of audited financial statements

- Monthly financial reports showing trends and seasonality

- Detailed revenue breakdowns by client, service, and team member

- Cost analysis and margin calculations by service line

Operational Documentation:

- Complete organizational chart with role descriptions

- Process documentation for all service delivery

- Client contract analysis and retention statistics

- Technology infrastructure overview and asset inventory

Legal Preparation:

- Corporate structure optimization

- Contract reviews and compliance verification

- Intellectual property documentation

- Employment agreement updates

Marketing and Buyer Identification

Business Broker Selection:

- Industry-specific brokers with agency sale experience

- Proven track record of successful agency transactions

- Strong buyer network and marketing capabilities

- Transparent fee structure and service offerings

Buyer Screening:

- Financial qualification and proof of funds

- Strategic fit assessment

- Cultural alignment evaluation

- Timeline and process compatibility

Due Diligence Management

Information Organization:

- Comprehensive data room with all requested documents

- Systematic response to buyer inquiries

- Regular communication updates throughout the process

- Professional presentation of all materials

Process Coordination:

- Legal counsel specialized in business sales

- Accounting support for financial analysis

- Insurance and bonding requirements

- Regulatory compliance verification

Maximizing Sale Value Through Strategic Positioning

The highest-value agency sales result from strategic positioning that highlights unique value propositions:

Differentiation Strategies

Specialization Premium:

- Deep expertise in specific industries or technologies

- Unique methodologies or proprietary processes

- Exceptional client results and case studies

- Recognized thought leadership and market position

Scale Advantages:

- Operational efficiency that's difficult to replicate

- Established vendor relationships and negotiated rates

- Proven ability to handle large, complex projects

- Geographic reach or market penetration

Technology Integration:

- Proprietary tools or systems that enhance service delivery

- Advanced analytics and reporting capabilities

- Automation that reduces delivery costs

- Integration capabilities that create client stickiness

Value Enhancement Tactics

Client Relationship Strengthening:

- Long-term contracts with automatic renewal clauses

- Integrated service delivery that's difficult to replace

- Strong client satisfaction scores and retention rates

- Diverse revenue streams from each client relationship

Team Development:

- Experienced management team capable of independent operation

- Comprehensive training programs and knowledge transfer

- Low turnover rates and strong employee satisfaction

- Clear succession planning for key positions

Financial Optimization:

- Consistent profitability and cash flow generation

- Efficient cost structure and margin optimization

- Predictable revenue growth and client acquisition

- Working capital management and cash conversion

Post-Sale Success Factors

Successful agency sales require planning for post-transition success:

Transition Planning

Management Handover:

- Comprehensive knowledge transfer to new leadership

- Client introduction and relationship transition

- Process documentation and training completion

- Performance metric establishment and monitoring

Client Retention:

- Proactive communication about ownership transition

- Continuity assurance for ongoing projects

- Service level maintenance during transition period

- Relationship building between clients and new management

Team Integration:

- Cultural alignment and integration planning

- Role clarification and career path development

- Compensation and benefit program alignment

- Performance management system implementation

Earn-Out Optimization

Most agency sales include earn-out provisions that depend on post-sale performance:

Performance Metrics:

- Clear, measurable targets with objective verification

- Realistic timelines that account for transition dynamics

- Fair adjustment mechanisms for external factors

- Regular monitoring and reporting requirements

Operational Continuity:

- Systematic handover of all business functions

- Maintained client relationships and service quality

- Preserved team motivation and performance

- Continued business development and growth

How Getmany Supports Agency Value Creation

Building a sellable agency requires systematic approach to lead generation, client management, and operational efficiency. Getmany provides the infrastructure that creates transferable value:

Documented Lead Generation

- Systematic proposal processes that operate independently of founder involvement

- Performance data that demonstrates consistent lead generation capability

- Client acquisition systems that provide predictable revenue growth

- Automated workflows that reduce manual intervention and founder dependency

Operational Efficiency

- Standardized processes that ensure consistent service delivery

- Performance metrics that provide visibility into business health

- Quality assurance systems that maintain client satisfaction

- Scalable infrastructure that supports growth without proportional cost increases

Client Relationship Management

- Comprehensive client histories and communication records

- Systematic account management processes

- Retention strategies that operate independently of founder relationships

- Diversified client portfolios that reduce concentration risk

Key Takeaways for Building Sale Value

- Start with the end in mind: Structure your agency for sale from day one, even if you never intend to sell

- Build transferable systems: Create processes and relationships that function independently of your involvement

- Focus on recurring revenue: Develop service models that provide predictable cash flow

- Document everything: Comprehensive documentation creates buyer confidence and reduces risk

- Develop strong management: Build a team capable of operating without your daily involvement

The most successful agency exits aren't the result of last-minute preparation—they're the natural outcome of systematic value creation over years of intentional business building. By focusing on transferable value, operational independence, and growth systems, you create an agency that's not just successful today, but valuable to future buyers.

Whether you ultimately choose to sell or not, building a sellable agency creates better systems, stronger teams, and more predictable results. The disciplines required for sale preparation are the same ones that create sustainable, scalable businesses.

Ready to build an agency with transferable value and exit potential? Getmany provides the systematic lead generation and operational efficiency that creates sellable agency characteristics, with automated systems that reduce founder dependency while maintaining growth and profitability.