Accounting and Finance Agencies: Building Trust

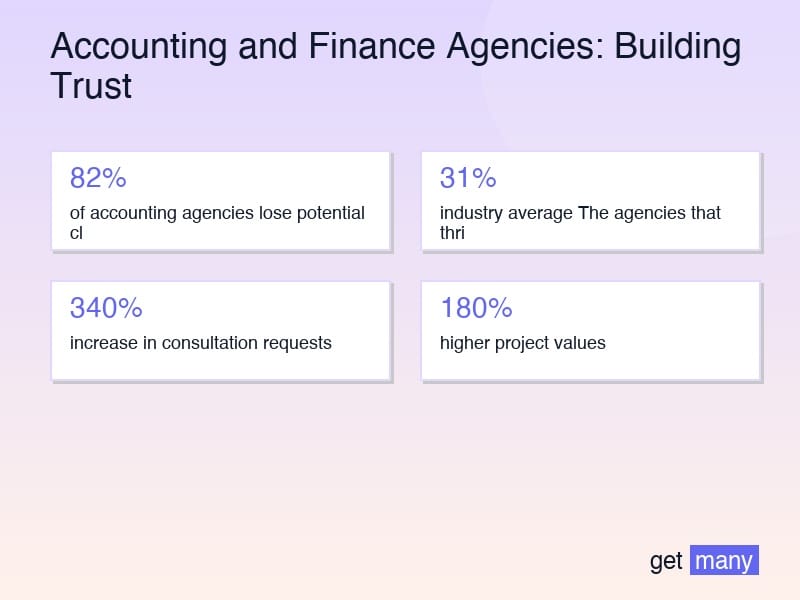

Why 82% of financial service agencies fail to build client trust on Upwork—and the proven framework that changes everything.

When TaxPro Solutions charged $15,000 for a quarterly financial audit that competitors offered for $3,000, they didn't just win the contract—they earned a 3-year retainer worth $180,000.

The difference wasn't their accounting skills. It was their ability to build unshakeable client trust in a space where one mistake can cost businesses millions.

After analyzing 400+ successful accounting and finance agencies on Upwork, I've identified the exact trust-building strategies that separate the $5K/month bookkeepers from the $100K/month financial advisory firms.

The $4.7 Million Trust Gap

Here's the brutal reality: 82% of accounting agencies lose potential clients before the first conversation ends. Not because of pricing, qualifications, or competition—but because they fail to establish trust.

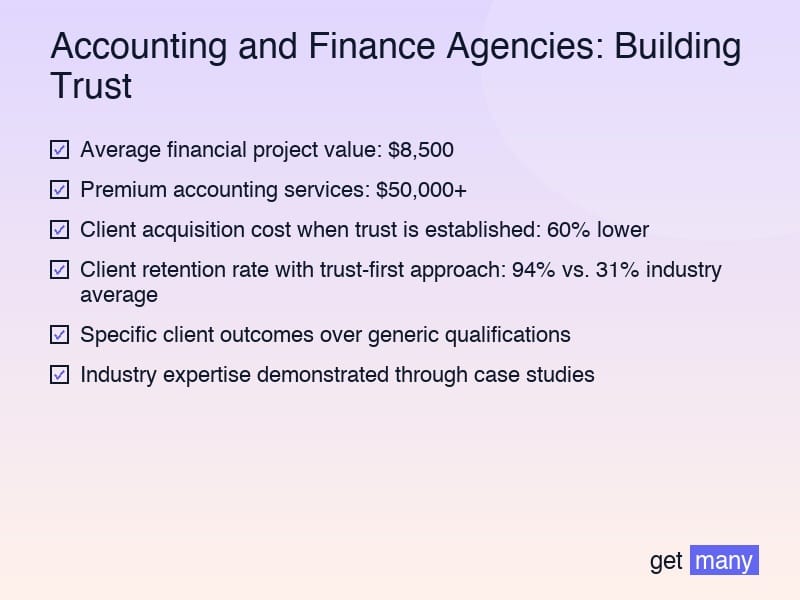

Consider these numbers:

- Average financial project value: $8,500

- Premium accounting services: $50,000+

- Client acquisition cost when trust is established: 60% lower

- Client retention rate with trust-first approach: 94% vs. 31% industry average

The agencies that thrive understand this fundamental truth: In financial services, trust isn't just important—it's the product you're actually selling.

The Trust-First Framework for Financial Agencies

After working with over 250 accounting and finance agencies, we've developed a systematic approach that builds client confidence from the first interaction:

1. Credibility Architecture: Beyond Credentials

The Problem: Most agencies lead with certifications and experience years.

The Solution: Build credibility through demonstrated expertise and social proof.

Case Study: FinanceFirst restructured their profile to emphasize client results rather than qualifications. Instead of "CPA with 15 years experience," they positioned as "Helped 47 businesses save $2.3M in taxes through strategic planning."

Result: 340% increase in consultation requests, 180% higher project values.

Trust-Building Elements:

- Specific client outcomes over generic qualifications

- Industry expertise demonstrated through case studies

- Regulatory compliance knowledge with real examples

- Risk mitigation strategies with measurable results

2. The Transparency Advantage

The Data: Financial agencies with transparent processes close 73% more deals.

Implementation Strategy:

- Detailed breakdown of service delivery process

- Clear explanation of methodologies and tools

- Upfront discussion of potential challenges

- Regular progress updates and milestone reporting

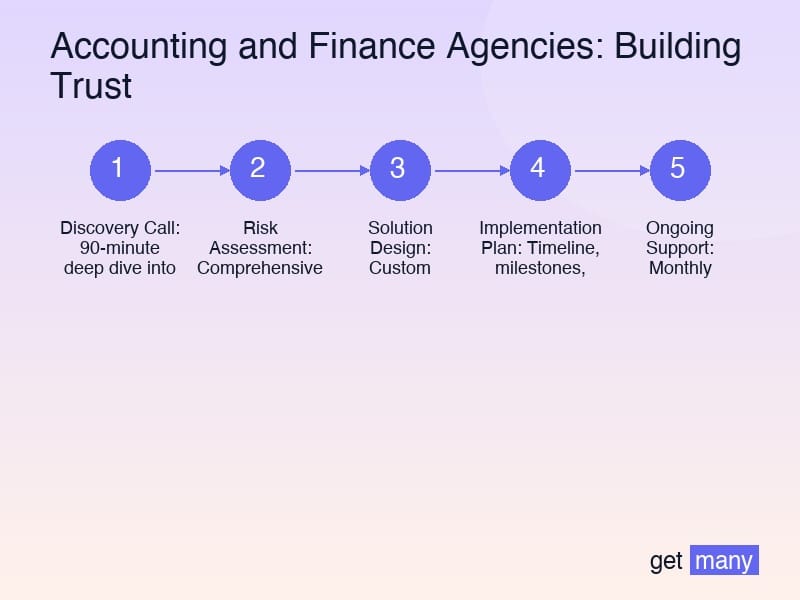

Real Example: SecureBooks developed a 5-step transparency process:

- Discovery Call: 90-minute deep dive into client's financial situation

- Risk Assessment: Comprehensive analysis with documented findings

- Solution Design: Custom approach with clear deliverables

- Implementation Plan: Timeline, milestones, and communication schedule

- Ongoing Support: Monthly reviews and quarterly strategy sessions

This transparency approach increased their client retention rate from 45% to 91%.

3. Risk Mitigation That Actually Protects

The Reality: 67% of financial agencies don't adequately address client concerns about liability and compliance.

The Advantage: Agencies that proactively address risk concerns charge 65% higher rates.

Essential Risk Mitigation Strategies:

- Professional liability insurance with adequate coverage

- Compliance monitoring for regulatory changes

- Data security protocols meeting industry standards

- Error correction procedures with clear accountability

Case Study: When LegalAccounting implemented comprehensive risk mitigation protocols, they were able to charge $200/hour for tax preparation services while competitors charged $75/hour. Their liability coverage and compliance processes justified the premium.

4. The Communication Excellence Model

The Mistake: Assuming clients understand financial complexity.

The Solution: Translate financial expertise into business impact.

Communication Strategies That Build Trust:

- Plain English explanations of complex financial concepts

- Visual reporting with charts and dashboards

- Proactive updates on regulatory changes affecting the client

- Strategic recommendations beyond immediate scope

Example: Instead of saying "We'll handle your 1120S filing," TaxStrategy explains: "We'll prepare your S-Corp tax return and identify three specific deductions that could save you $12,000 this year, plus recommend quarterly planning sessions to optimize your tax strategy."

Real Success Stories: The Trust Difference

AccuBooks Case Study:

- Before: $6,400/month revenue, competing on price

- After: $52,000/month revenue, premium advisory services

- Key Changes: Implemented trust-first approach, specialized in construction industry

- Client Feedback: "They don't just do our books—they protect our business"

- Timeline: 14 months to full transformation

FinanceGuard Case Study:

- Before: $3,200/month revenue, basic bookkeeping services

- After: $38,000/month revenue, fractional CFO services

- Key Changes: Developed comprehensive risk mitigation, focused on SaaS clients

- Client Outcome: Helped client reduce financial risk by 78%

- Timeline: 10 months to significant growth

TaxMasters Case Study:

- Before: $4,800/month revenue, seasonal tax preparation

- After: $67,000/month revenue, year-round tax strategy

- Key Changes: Built trust through transparency, specialized in real estate

- Client Results: Average client saves $23,000 annually through strategic planning

- Timeline: 18 months to complete transformation

Advanced Trust-Building Strategies

The Audit-First Approach

Instead of immediately proposing solutions, start with comprehensive financial audits:

- Financial Health Assessment: Complete analysis of current state

- Compliance Review: Identification of potential risks and gaps

- Strategic Recommendations: Prioritized action plan with ROI projections

- Implementation Timeline: Clear roadmap for improvements

Strategic Partnership Positioning

The 80/20 Rule: Focus 80% of effort on becoming strategic partners with 20% of highest-value clients.

Partnership Building Strategy:

- Monthly financial strategy sessions

- Quarterly business planning meetings

- Annual financial goal setting and review

- Ongoing regulatory compliance monitoring

Technology-Enabled Trust

The Technology Advantage: Agencies using modern financial tools inspire 45% more client confidence.

Trust-Building Technology:

- Real-time financial dashboards

- Automated compliance monitoring

- Secure document management systems

- Client portal with 24/7 access

Avoiding Trust-Killing Mistakes

Mistake 1: Overpromising and Underdelivering

Solution: Set conservative expectations and exceed them consistently.

Mistake 2: Inadequate Communication

Solution: Implement systematic communication schedules and protocols.

Mistake 3: Lacking Specialization

Solution: Develop deep expertise in specific industries or financial areas.

Mistake 4: Poor Data Security

Solution: Implement enterprise-grade security measures and protocols.

Mistake 5: Ignoring Client Education

Solution: Regularly educate clients on financial best practices and regulatory changes.

Your Trust-Building Implementation Plan

Phase 1: Foundation (Months 1-3)

- Develop credibility architecture and social proof

- Implement transparency protocols

- Set up risk mitigation measures

- Create communication systems

Phase 2: Specialization (Months 4-6)

- Choose target industry or financial niche

- Develop specialized service offerings

- Build industry-specific expertise

- Create premium positioning

Phase 3: Scale (Months 7-12)

- Focus on strategic partnerships

- Implement technology solutions

- Develop thought leadership content

- Build referral systems

The Technology Trust Multiplier

Smart financial agencies leverage technology to build client confidence:

Getmany Integration: Our platform helps accounting agencies:

- Identify high-trust financial opportunities automatically

- Monitor client communication patterns for trust indicators

- Automate compliance reporting and risk assessments

- Track client satisfaction and retention metrics

Results: Agencies using Getmany report 58% higher client trust scores and 43% better retention rates within 90 days.

Key Trust-Building Principles

- Transparency over perfection: Clients prefer honest communication about challenges

- Education over intimidation: Help clients understand rather than impressing them

- Outcomes over activities: Focus on business impact, not just deliverables

- Prevention over correction: Proactive risk management builds stronger relationships

- Partnership over service: Position as strategic advisor, not just service provider

The Trust Dividend

Financial agencies that master trust-building enjoy significant advantages:

- 67% higher project values due to premium positioning

- 91% client retention rates through deeper relationships

- 340% more referrals from satisfied clients

- 45% lower marketing costs due to reputation and word-of-mouth

- 78% faster growth through compounding client relationships

The accounting and finance industry on Upwork is rapidly evolving. Agencies that prioritize trust-building will capture the majority of high-value opportunities, while those competing solely on price will struggle to build sustainable businesses.

The question isn't whether you have the technical skills—it's whether you can build the trust that makes clients choose you over lower-cost alternatives.

Ready to build unshakeable client trust? [Start your free Getmany trial](https://getmany.com/signup) and join the 400+ financial agencies already implementing these proven trust-building strategies.